Farm Tax Webinar Recordings & Resources

go.ncsu.edu/readext?995080

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲

The Chatham County Center of North Carolina Cooperative Extension conducted a Farm Tax Webinar Series in early 2024 for farmers, nursery growers, beekeepers, and other ag professionals. Each webinar was approximately two hours long and included a presentation plus a question and answer session.

All four webinars are available for viewing. The first three were taught by Guido van der Hoeven. The last webinar was taught by Andrew Branan. Their bios are provided at the bottom of the page below the Resources section.

Webinar Recordings:

North Carolina Resources

Understanding Sales and Use Taxes on Agricultural Products – NC Department of Revenue

Sales and Use Tax Bulletins – NC Department of Revenue

Registration for Sales Tax Remittance – NC DOR

Video: Online File & Pay – Sales and Use Tax Due in One County in NC

Video: Online File & Pay – Sales and Use Tax Due in Multiple Counties in NC

Present Use Value Program Guide

NC State Extension Resources

Agricultural and Natural Resource Law Portal

New Workbook: So You Inherited a Farm

Getting into Farming: a Workbook for Beginning Farmers in North Carolina

Farm Succession and Transfer Resources

Leases and Farm Tenure Resources

Estate Planning and Administration Resources

Zoning for Farming and Forestry Resources

Business Organizations and Agreements

Taxes, Licensing, and Zoning Resources

Employment and Labor Resources

Limited Liability Companies: Steps in Formation

Present Use Value: Why it Matters – NC State Extension

Present Use Value: The Basics of Agricultural and Forest Use Property Tax – NC State Extension

Present Use Value Program a Benefit for Qualified Farm and Forest Landowners – NC State Extension

Present Use Value: Transferring Property Enrolled in Present Use Value Property Taxation

Federal Tax Resources

Agricultural Employer’s Tax Guide

Other Farm Tax Education Resources

Farm Tax & Business Resources

Center for Agricultural Law and Taxation at Iowa State University

Finding a Tax Preparer

North Carolina Chapter of the National Society of Accountants

North Carolina Chapter of the National Association of Tax Professionals (NATP)

North Carolina Association of CPAs

Commonly Used Business Income Tax Forms

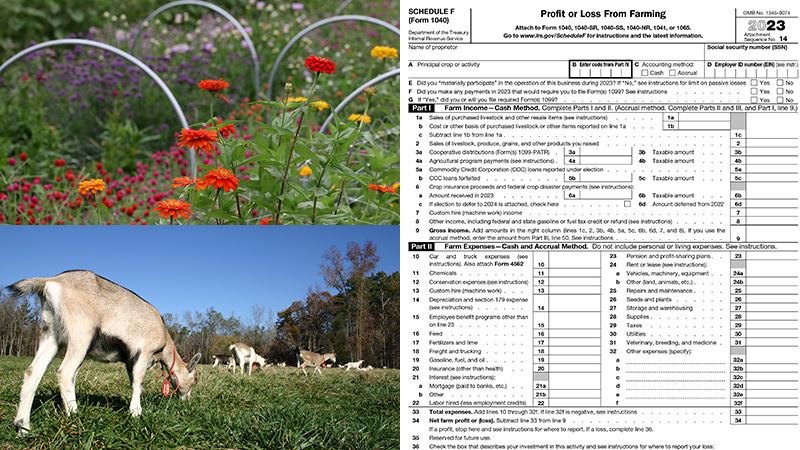

Schedule F: Profit or Loss from Farming

Schedule C: Profit or Loss from Business

Schedule E: Supplemental Income and Loss

Form 1065: Partnership Tax Return (LLCs too)

Form 1120-S: Sub-S Corp Tax Return

Supporting Tax Forms to Business Returns

Form 4562: Depreciation and Amortization

Form 4797: Sale of Business Assets

Form 6252: Installment Sale Income

Schedule SE: Self-Employment Tax

Schedule D: Capital Gains and Losses

Form 8949: Sales and Other Dispositions of Capital Assets

Other Common Tax Forms for/used on Individual Tax Returns

IRS Form 1040: Individual Tax Return

Schedule 1, Form 1040: Additional Income and Adjustments to Income

Schedule 2: Form 1040: Additional Taxes

Schedule 3: Form 1040: Additional Credits and Payments

Schedule A: Itemized Deductions

Schedule B: Interest and Ordinary Dividends

Informational Returns Commonly Used in Agriculture

Presenter Bios:

Guido van der Hoeven retired as an Extension Specialist/Senior Lecturer in the Department of Agricultural and Resource Economics at North Carolina State University in 2019. Guido’s Extension responsibilities included: income taxation of individuals and business entities, farm business management and the profitable continuation of “family firms” to succeeding generations. Guido van der Hoeven currently operates a consulting business, vdH Consulting, in which he is the Principal Consultant. VdH Consulting offers tax education, tax planning, business succession planning, and general rural business strategy. Van der Hoeven serves as President of the Land Grant University Tax Education Foundation, Inc. which publishes a ~650-page text for income tax training of professional tax practitioners and a ~220-page text focusing on Agricultural Taxation.

Robert Andrew Branan, JD is an Associate Extension Professor with the Agriculture and Natural Resources (ARE) Department of the College of Agricultural and Life Sciences, North Carolina State University. Andrew is a legal educator/researcher in agriculture with 20+ years experience working across North Carolina and the Southeast, including private and non-profit law practice in agricultural land use, environmental and natural resource law. His focus on farm succession, agribusiness and taxation, farmland preservation, land use regulation, water and natural resource protection, and heir property issues has placed him in speaking and community resource roles across the North Carolina. His campus courses include Environmental Law and Economic Policy and Agriculture Law. Prior to joining ARE, Andrew’s solo law practice served farmers, landowners and food entrepreneurs across North Carolina and Virginia on matters of business planning and management and asset transfer. He has authored the workbooks Planning the Future of Your Farm and So You Have Inherited a Farm, the latter focusing on co-tenancy resolution. Andrew graduated from Hampden-Sydney College in Virginia with degrees in Economics and History and earned his juris doctorate from Wake Forest University Law School. He lives with his family in Chapel Hill, North Carolina.